~ Welcome to vol19 of #thebalance ~

Back from a great trip out west this last week, with a quick pit stop in Little Canada (aka Minny) this weekend on my way back to NYC. Thanks for all the reader responses on things to do / places to see while out in San Francisco… it’s truly a special town, although I think I may still be a bit partial to New York :)

Speaking of which, its OCTOBER. My favorite time of year and where #thebalance is right at home (ahem, ♎⚖️ ) especially with yours truly also having a bday this month. You might say I live for balance…. ha ha ha

Speaking of balance though, humans vs. computers… the battle for financial return and global money power. Who will win? Look no further than today’s capital markets for an indication on where things are headed in the global economy.

Inspired by a lengthy feature from The Economist, I will be covering FINANCIAL MACHINES aka the digitization of financial markets and including text from the feature. Thus, hopefully, furthering your understanding on the inner workings financial markets and why you should care to know more.

(I won’t be going deep on strategies or covering differences in HFT approaches, etc.)

Highlights, include:

🤔🤔 #GetSmart >>> The elimination of the human ‘Wolf’ of Wall Street happening right before our eyes. Covering financial markets, electronic trading, and the trader’s quest for return. What could be more thrilling?

📚📚 #GetReadin’ >>> Highlighting a book on the finance hero’s journey. A classic by Michael Lewis, particularly if you geek out on investor & stock market stuff like I do #flashboys

🍂🍂 #GetDoin’ >>> A couple photos from my weekend in Minny, where its my favorite time of the year #fallcolors

⬇️ More below ⬇️

_______________________

EDITOR’S NOTE: As the current format of these newsletters take quite a bit of energy/effort to collating the info for the topics I dive deep on, you may see me experimenting a bit more with the format going forward. Please provide feedback (+/-). After all, these newsletters are meant to be a value add for you.

***Just as a refresher, the core thesis of this newsletter is to pique your curiosity by aggregating interesting topics in a thematic, bite sized, and relevant manner (w/ original posts occasionally) - ranging from blog posts, books, music, events, podcasts, and ideas on how to stay active, travel or otherwise... And please keep sending feedback my way… the goal is to make this thing worth it for you!***

If you like what you’re reading, please share by forwarding (see ‘sign up now’ button) this email onto your people in your network and/or Tweet some support!

_______________________

#GetSmart

🤔🤔 Today’s financial markets are increasingly powered by computers and often operated by humans who may not entirely understand the system that they are operating.

>>>> The Importance of Markets (my two cents)

Finance underpins just about everything in today’s modern societal structure.

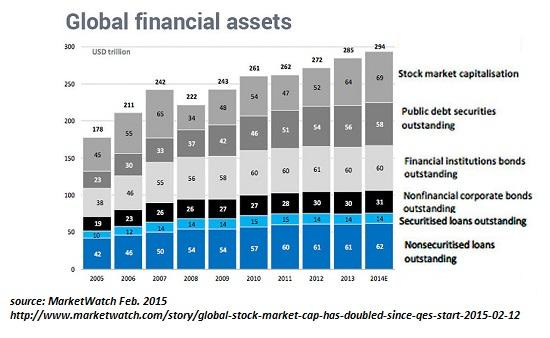

Think about finance & capital as the “fuel” for today’s economy, the fire that keeps us all living in this capitalistic society warm at night. That is why the term “growth” is so prevalent in capitalism… growth is the result of a healthy financial system… without growth, modern society’s structures risk collapsing. All industries touch the financial system in some form or another… a system that has ~$300 trillion in value attributed to it!!

So what does it mean when the system we all depend on in some shape or form… the system we interact with almost daily… the system that has a significant stake in our overall well being… undergoes significant structural change? Disrupted from the inside out, if you will.

Well look no further, than ₿itcoin ….only kidding, this will not be a crypto-focused post this week :)

Although, if you are curious about crypto and the intersection of financial markets, please do check out my previous post on crypto & Libra.

>>>> Financial Markets Defined

Just to set a base, particularly for those non-finance folks out there, I thought this was a decent high level overview of financial market structure:

As the CFI puts it, “Financial markets, from the name itself, are a type of marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives. Simply put, businesses and investors can go to financial markets to raise money to grow their business and to make more money, respectively.”

In other words, financial markets touch just about everything in today’s economy. Whether you are shopping online, going out to eat, starting / operating a business, or buying a house…. you directly or indirectly depend on financial markets and the health of these markets.

>>>> Markets Rule Everything Around Me

Did you know that there are actually 60+ stock exchanges around the world that generate ~$70 TRILLION in value?

>>>> Wall Street Gone Digital

From the Economist, “Funds run by computers that follow rules set by humans account for 35% of America’s stock market, 60% of institutional equity assets and 60% of trading activity. New artificial-intelligence programs are also writing their own investing rules, in ways their human masters only partly understand. Industries from pizza-delivery to Hollywood are being changed by technology, but finance is unique because it can exert voting power over firms, redistribute wealth and cause mayhem in the economy.”

Each day around 7bn shares worth $320bn change hands on America’s stock market

A good chunk of the volume is high-frequency trading (i.e. electronic trading, see below), in which stocks are flipped at speed in order to capture fleeting gains. High-frequency traders, acting as middlemen, are involved in half of the daily trading volumes.

Three years ago quant funds became the largest source of institutional trading volume in the American stock market, accounting for 36% of institutional volumes these days

>>>> Passive vs. Active Investing

More from the Economist… “Fifty years ago investing was a distinctly human affair. ‘People would have to take each other out, and dealers would entertain fund managers, and no one would know what the prices were,’ says Ray Dalio, who worked on the trading floor of the New York Stock Exchange (nyse) in the early 1970s before founding Bridgewater Associates, now the world’s largest hedge fund. Technology was basic.”

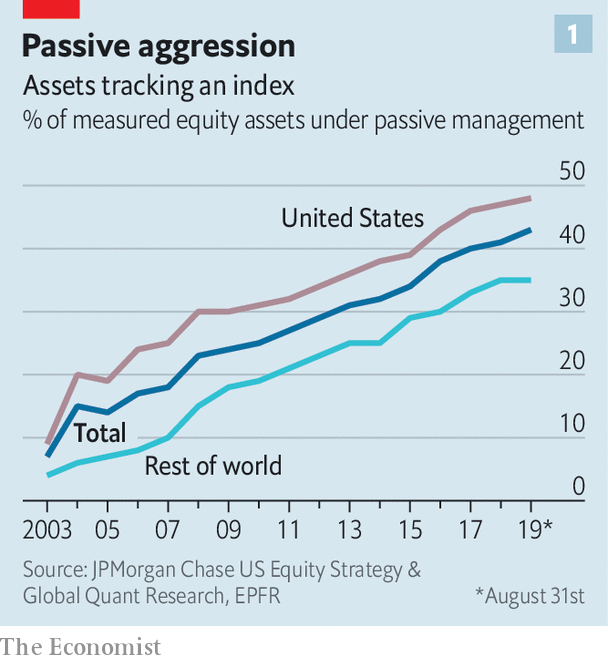

Since then the role humans play in trading in the markets has shrunk TREMENDOUSLY. Just look at this chart.

🤯🤯On September 13th a widely watched barometer published by Morningstar (shout out my bro’s company!), reported that last month, for the first time, the pot of passive equity assets it measures, at $4.3trn, exceeded that run by humans.

>>>> Electric Efficiency

The result of all this electronification is that the stock market is now extremely efficient… which is generally good for us investors (institutions and / or regular people like you and I).

The new robo-markets bring much lower costs for everyone. The lower barriers of entry to trading in traditional markets now means that new information about a company is instantly reflected in its price… i.e. order execution is much better, which is generally great for all.

+ +Cheaper fees have added to liquidity (which determines how much a trader can buy or sell before he moves the price of a share). More liquidity means a lower ‘spread’ between the price a trader can buy a share and the price he can sell one. 🌊🌊

Of the $18trn to $19trn of managed assets accounted for, most are looked after by machines. Index funds manage half of that pot, around $9trn (remember above chart).

The remaining 35-40%, worth $7 to $8trn, is overseen by humans, but is shrinking

(…this chart boggles my mind)

>>>> The Law of Big Numbers

High Frequency Trading or ‘HFT’ for short, is the official name for computer powered trading. Investopedia defines it as, “a platform that uses powerful computers to transact a large number of orders in fractions of a second. It uses complex algorithms to analyze multiple markets and execute orders based on market conditions. Typically, the traders with the fastest execution speeds are more profitable than traders with slower execution speeds.”

This is now what is happening across the board, behind the scenes in most financial markets, on all exchanges… equity markets or otherwise.

The major benefit of HFT is it has improved market liquidity for everyone and removed bid-ask spreads that previously would have been too small.

Side note on liquidity, a very important term that, in my opinion is massively misunderstood. One of my favorite memos is Howard Marks on Liquidity.

Fears about these HFT shops trading in the wild, (aside from the replacement of human stock broker) is that it, for better or worse, has removed human decision and interaction out of the equation. Buys or sells happening in milliseconds, which has caused a race to the bottom and sometimes results in big market moves without reason (i.e. “flash crashes”, like in 2010 when more than 5% was wiped off the value of the s&p 500 in a matter of minutes).

>>>> Leveling the Playing Field

To combat the electronification of the markets, the Investor’s Exchange (‘IEX’) launched in 2012 to help make thing a bit easier for the average investor to compete.

Under America’s equity-exchange duopoly (the New York Stock Exchange and Nasdaq), Mr Katsuyama (CEO, Founder, and main character of Flash Boys) argues, retail investors pay too much for data and a fast connection, and are outpaced by high-speed traders’ algorithms aka HFTs (Cboe, the third-largest, focuses on exchange-traded funds). IEX’s fees, he says, are fair and simple by comparison. It also routes orders over a “speed bump”, a coil of fibre-optic cable that slows access to the market by 350 microseconds.

See #GetReadin’ book recco below if you are interested in the full story behind the founding of IEX.

>>>> Read the Fine Print

You may have used the Robinhood App for free stock trading before or seen the news more recently that “so and so” brokerage is now offering ‘commission-free trading’ on said online platform for retail users. I wanted to make sure I gave a quick overview on the commission free trading approach (and no, I will not be advocating for one approach and/ or offering investment advice):

Free trading will likely save you money up front with no trading costs

But if it causes you to trade rashly, your returns may suffer… as a rule of thumb, long term HODLing is almost always a better approach when buying a financial asset (unless you are knowledgeable on the risk with purchasing said asset)

But these free “brokerages” may recoup the costs in less transparent ways (i.e. its free up front, but you are paying behind the scenes)

Widening the bid/ask spread on your buy or sell… e.g. when you trade a stock in your account you might lose money instantly compared to the broader market price (this has to do with market makers and HFTs behind the scenes).

Selling your data… or your order-flow data, to be exact. This can disadvantage the retail trader (aka you and I) because the data can be used by other market participants to arbitrage activity around short-term trades and potentially your trades… thus, causing you to lose money.

….. Reach out to me direct if you have any questions on what this means for you in more detail (but not for investment advice).

>>>> Final Word

A bit ominous, but I can’t help but think about this quote when I think of politics/ the economy/ capital markets/ the state of the world sometimes. I am an optimist at heart, I promise!!

“…some men aren’t looking for anything logical, like money. They can’t be bought, bullied, reasoned, or negotiated with. Some men just want to watch the world burn.”

#GetReadin’

📚📚 If you are curious about how the traditional financial markets actually work behind the scenes, I recommend picking up a copy of Michael Lewis’ Flash Boys. It is a good story about the people that discovered the power high frequency trading has in equity markets particularly and will open your eyes to a world where making money is powered by computers.

In Michael Lewis's game-changing bestseller, a small group of Wall Street iconoclasts realize that the U.S. stock market has been rigged for the benefit of insiders. They band together―some of them walking away from seven-figure salaries―to investigate, expose, and reform the insidious new ways that Wall Street generates profits. If you have any contact with the market, even a retirement account, this story is happening to you.

#GetDoin’

🍂🍂Get outside! Fall colors be a changin’. Below are a couple shots from this weekend / of my parent’s golden retriever, Kramer. I took them this weekend while doing a little nature detox back in Minnesota.

^^ trails of Deephaven, MN

^^ my bud, Kramer

^^Kramer discovered a turkey in a tree (who knew that was a thing??)

^^Lake Minnetonka, MN; view from my parent’s house

Have a great week all!!

Curiously,

Brian

***Including a snippet from the Exponential View newsletter (a must read for me each week), which posts the below carbon tracker. Latest update below:

😢😢 “Each week, we’re going to remind you of the CO2 levels in the atmosphere.

Each week, we’re going to remind you of the CO2 levels in the atmosphere and the number of days until reaching the 450ppm threshold.

The latest measurement (as of October 2): 407.72ppm; October 3, 2018: 405.62ppm; 25 years ago: 360ppm; 250 years ago, est: 250ppm. Share this reminder with your community by forwarding this email or tweeting this.Focus on the delta over the past 12 months. The delta itself continues to increase. We are ~3,883 days from the dreaded 450ppm threshold.”***

A little bit about me:

My friends call me Block. Minnesota born & raised, I now live and work in New York City.

I am endlessly curious and eternally optimistic. I have a passion for new ideas, obsessed with all things technology, and am always seeking to broaden my perspective while striving for balance.

I am an open finance enthusiast, futurist, investor, entrepreneur, builder, advisor, life long learner, hockey player, traveler, podcast addict, hip-hop head, e-newsletter junkie, event planner, and comedic-short producer. Follow me on Twitter here and Instagram here.

“Find a question that makes the world interesting.” - Paul Graham

Please make sure to add #thebalance newsletter to your ‘my contacts’ list so you don’t miss out on the mostly weekly emails. There have been reports of gmail junkin’ this beautiful newsletter.

If you enjoy #thebalance newsletter, please show some love on the interwebs. Tweet some support!